Introduction: The world of cryptocurrency trading is dynamic, thrilling, and filled with opportunities. However, like any financial market, it comes with its own set of challenges. To navigate these challenges and come out on top, traders need a combination of knowledge, experience, and the right strategies. This article delves deep into the realm of crypto trading, offering insights, strategies, and techniques that can help both beginners and seasoned traders achieve success. Let’s embark on this exciting journey together!

Capítulo 1: Comprendiendo lo Esencial de las Estrategias de Trading de Criptomonedas

“Success in crypto trading is not about finding the ‘best’ strategy, but about finding the ‘right’ strategy for you.”

Cryptocurrency trading is not a one-size-fits-all endeavor. What works for one trader might not work for another. It’s essential to understand the various strategies available and then choose one (or a combination) that aligns with your trading goals, risk tolerance, and market outlook.

- Value Investing: This strategy is all about identifying undervalued altcoins that show promise for long-term growth. It requires a deep understanding of the crypto market and the ability to predict which coins have the potential to deliver significant returns in the future.

- Momentum Trading: As the name suggests, this strategy involves riding the wave. Traders buy coins that are on an upward trajectory and sell those that are on a decline. It’s about capturing the momentum and making profits before the trend reverses.

- Swing Trading: This is for those who have the patience to wait. Swing traders hold onto their positions for days or even weeks, capitalizing on intermediate-term price movements.

- Trend Trading: “The trend is your friend.” This strategy is about identifying and following market trends. Whether the market is bullish or bearish, trend traders look for opportunities to buy low and sell high or vice versa.

- Day Trading: For those who love the thrill of the market, day trading is the way to go. It involves making multiple trades within a single day, capitalizing on short-term price fluctuations.

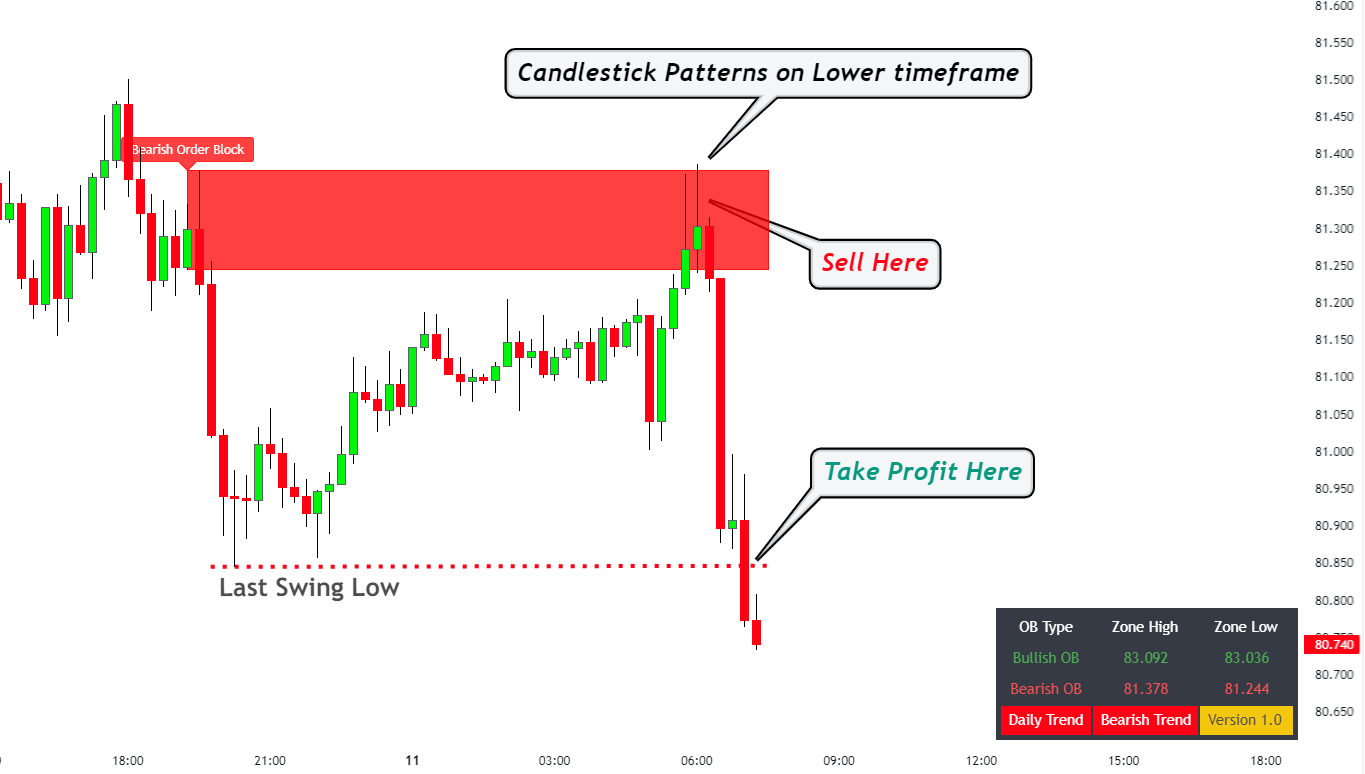

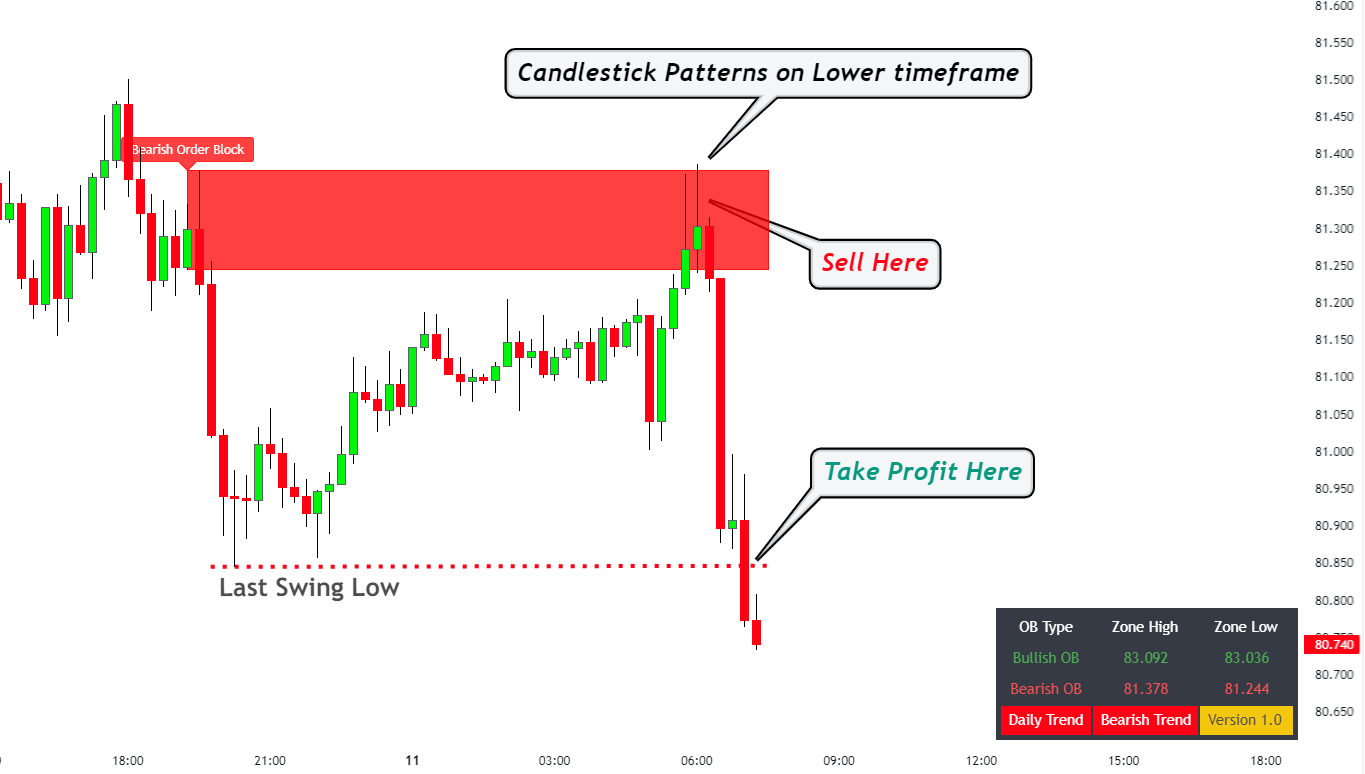

- Technical Analysis: This strategy is for the analytical minds. It involves studying charts, patterns, and technical indicators to predict future price movements.

Relevant Link: A Comprehensive Guide to Technical Analysis

Capítulo 2: Profundizando en el Análisis Técnico

“In the world of crypto trading, charts speak louder than words.”

Technical analysis is a cornerstone of crypto trading. By studying past market data, traders can identify patterns and trends that can help predict future price movements. Here’s a closer look at some key concepts:

- The Essence of Technical Analysis: At its core, technical analysis believes that market trends tend to repeat themselves. By analyzing past data, traders can identify patterns and use this information to make informed trading decisions.

- Support and Resistance: These are crucial concepts in technical analysis. Support is a price level where demand is strong enough to prevent further decline, while resistance is where the supply is robust enough to stop a price rise. Understanding these levels can help traders make strategic entry and exit decisions.

- Chart Patterns: These are formations that appear on cryptocurrency charts, signaling potential future price movements. Some common patterns include the Head and Shoulders, Flag and Pennant, and the Double Top and Bottom.

- Technical Indicators: These are tools that traders use to predict future price movements. Some popular indicators include Moving Averages, Bollinger Bands, and the Relative Strength Index (RSI).

- The Limitations: While technical analysis is a powerful tool, it’s not infallible. Market conditions can change rapidly, and no single strategy guarantees success. It’s essential to use technical analysis in conjunction with other strategies and always be prepared to adapt.

Relevant Link: Understanding Technical Analysis in Trading

Capítulo 3: El Poder del Análisis Fundamental en el Trading de Criptomonedas

“Behind every coin is a story waiting to be told.”

While technical analysis focuses on charts and patterns, fundamental analysis delves into the intrinsic value of a cryptocurrency. It’s about understanding the bigger picture and the factors that drive a coin’s value.

- Understanding the Basics: Fundamental analysis involves evaluating a cryptocurrency’s value based on real-world factors like technology, team, use-case, partnerships, and more.

- Whitepapers – The Crypto Bible: Every cryptocurrency starts with a whitepaper. It’s a document that outlines the coin’s purpose, technology, mechanism, and future plans. A thorough analysis of a whitepaper can provide invaluable insights into a coin’s potential.

- Market News & Events: The crypto market is highly sensitive to news. Regulatory changes, technological advancements, partnerships, and even rumors can significantly impact prices. Staying updated with the latest news is crucial.

- Community & Adoption: A strong community backing and real-world adoption can be indicative of a coin’s long-term potential. Platforms like Reddit, Twitter, and crypto-specific forums are excellent places to gauge community sentiment.

- Limitations: Just like technical analysis, fundamental analysis is not foolproof. The crypto market is known for its volatility, and even coins with strong fundamentals can experience sharp price fluctuations.

Relevant Link: Introduction to Fundamental Analysis

Capítulo 4: Gestión del Riesgo – El Héroe Desconocido del Trading

“In the world of trading, it’s not just about making profits; it’s about protecting them.”

Risk management is perhaps the most overlooked aspect of trading, yet it’s the backbone of a successful trading strategy. It’s about making informed decisions to protect your investments.

- Setting Stop-Losses: This is a predetermined price at which a trader will sell a coin to prevent further losses. It’s a safety net that every trader should use.

- Diversification: “Don’t put all your eggs in one basket.” Diversifying your investments across multiple coins can spread the risk.

- Position Sizing: It’s essential to decide beforehand how much of your portfolio you’ll invest in a particular trade. This ensures you don’t overexpose yourself to risk.

- Emotional Discipline: Trading can be an emotional rollercoaster. It’s crucial to stay calm, stick to your strategy, and avoid making impulsive decisions.

- Continuous Learning: The crypto market is ever-evolving. Regularly updating your knowledge and adapting your strategies is key to managing risks effectively.

Relevant Link: Principles of Risk Management

Capítulo 5: La Psicología del Trading – Dominando tu Mente

“In trading, your biggest opponent is not the market; it’s yourself.”

The psychological aspect of trading is often underestimated. However, understanding and mastering your emotions is key to long-term success in the crypto market.

- Greed & Fear: These are the two most dominant emotions in trading. While greed can make you hold onto a losing position for too long, fear can make you sell too early. Recognizing these emotions and keeping them in check is crucial.

- Overconfidence: Just because you’ve had a few successful trades doesn’t mean you’re invincible. Overconfidence can lead to reckless decisions.

- Accepting Losses: Not every trade will be a winner. Accepting losses and learning from them is a vital part of a trader’s journey.

- Staying Informed: Knowledge is power. The more you know, the more confident and rational your decisions will be.

- Mental Resilience: The crypto market is not for the faint-hearted. Building mental resilience can help you navigate the highs and lows with grace.

Relevant Link: The Role of Psychology in Trading

Capítulo 6: Herramientas y Plataformas Avanzadas de Trading

“In the digital age of crypto trading, the right tools can be the difference between success and stagnation.”

The crypto trading landscape is vast, and having the right tools at your disposal can significantly enhance your trading experience. This chapter delves into some of the advanced tools and platforms that can elevate your trading game.

- Crypto Wallets: Beyond just a place to store your coins, modern crypto wallets offer functionalities like staking, swapping, and even lending. Understanding hot vs. cold storage and choosing the right wallet can be pivotal.

- Trading Bots: In a market that never sleeps, trading bots can be your 24/7 allies. They can execute trades based on predefined criteria, ensuring you never miss an opportunity.

- Decentralized Exchanges (DEXs): Move over traditional exchanges; DEXs are here to revolutionize trading. They offer peer-to-peer trading, often with lower fees and enhanced security.

- Leverage & Margin Trading: While risky, leverage allows traders to amplify their positions. Platforms offering margin trading can be a boon for experienced traders looking to maximize gains.

- Portfolio Trackers: Keeping tabs on all your investments can be a chore. Portfolio trackers simplify this, giving you a holistic view of your assets and their performance.

- Research Platforms: Platforms like Messari, CoinGecko, and others offer in-depth insights, analytics, and data that can be invaluable for traders.

Relevant Link: Top Crypto Trading Tools Reviewed

Capítulo 7: El Impacto Global – Cómo los Eventos Mundiales Moldean las Criptomonedas

“When the world speaks, crypto listens.”

The crypto market, while decentralized, doesn’t exist in a vacuum. Global events, from political upheavals to economic shifts, can have profound impacts on the crypto landscape.

- Regulatory Changes: Governments worldwide are still grappling with how to regulate crypto. Policies, bans, or endorsements by governments can cause significant market movements.

- Economic Factors: Inflation rates, interest rates, and economic crises in traditional markets often see reflections in the crypto world. For instance, economic downturns have historically seen a surge in crypto as an alternative investment.

- Technological Advancements: Breakthroughs in blockchain technology, quantum computing, or even simple upgrades (like Ethereum’s transition to Proof of Stake) can influence crypto prices and adoption rates.

- Global Crises: Events like the COVID-19 pandemic have showcased crypto’s potential as a safe haven, with Bitcoin often touted as ‘digital gold’.

- Mainstream Adoption: When big players like Tesla or Square invest in or endorse crypto, it doesn’t just bring in funds; it brings legitimacy and widespread attention.

- Geopolitical Events: Trade wars, sanctions, and even elections can influence the crypto market. Countries facing sanctions might turn to crypto as an alternative to the traditional banking system.

Relevant Link: How Global Events Affect the Crypto Market

Capítulo 8: El Debate Ecológico – Criptomonedas y el Medio Ambiente

“As crypto soars, so does its responsibility towards the planet.”

The environmental impact of cryptocurrencies, especially Bitcoin, has been a hot topic of debate. This chapter sheds light on the ecological footprint of crypto and the steps being taken to mitigate it.

- Proof of Work vs. Proof of Stake: Understanding the energy consumption of these consensus mechanisms is crucial. While PoW, used by Bitcoin, is energy-intensive, PoS offers a more eco-friendly alternative.

- Carbon Footprint of Major Cryptos: A deep dive into the energy consumption of major cryptocurrencies and their impact on the environment.

- Green Cryptos: Highlighting cryptocurrencies that are taking steps to reduce their carbon footprint or are inherently eco-friendly.

- Mining and Energy Consumption: A look into crypto mining, its energy requirements, and the search for renewable energy sources.

- The Role of Big Players: How major companies and personalities, from Elon Musk to major mining pools, influence and drive the green crypto debate.

- Future Solutions: Exploring upcoming solutions, from Layer 2 protocols to green mining initiatives, that aim to make crypto more sustainable.

Relevant Link: The Environmental Impact of Cryptocurrencies

Capítulo 9: El Auge de los NFTs – Más Allá de las Criptomonedas

“In the digital realm, ownership finds a new meaning with NFTs.”

Non-Fungible Tokens (NFTs) have taken the world by storm, revolutionizing art, gaming, and collectibles. This chapter delves into the fascinating world of NFTs and their potential.

- Understanding NFTs: What are NFTs, and how do they differ from traditional cryptocurrencies?

- The Art Revolution: How NFTs are changing the art world, offering artists better royalties, and creating digital masterpieces.

- Gaming and NFTs: The integration of NFTs in gaming, allowing players to truly own in-game assets.

- Collectibles and Memorabilia: From sports cards to music albums, how NFTs are redefining collectibles.

- The Economic Implications: The potential of NFTs to create new economic models and opportunities.

- Challenges and Criticisms: Addressing the concerns, from environmental issues to market bubbles, associated with NFTs.

Relevant Link: The World of NFTs Explained

Capítulo 10: El Futuro de las Criptomonedas – Integración Cotidiana y Más Allá

“Tomorrow’s world is decentralized, digital, and driven by crypto.”

As we stand on the cusp of a new era, it’s essential to look ahead and envision a world where cryptocurrencies are an integral part of daily life.

- Crypto in Everyday Transactions: The potential of cryptocurrencies to become mainstream, from buying coffee to purchasing homes.

- Decentralized Finance (DeFi): How DeFi is set to revolutionize banking, lending, and financial services.

- Crypto and the Gig Economy: The role of cryptocurrencies in empowering freelancers and gig workers globally.

- Government and Crypto: The potential of central bank digital currencies (CBDCs) and the future of government-backed cryptocurrencies.

- Challenges Ahead: Addressing the hurdles, from regulatory challenges to scalability issues, that crypto needs to overcome.

- A Vision of the Future: Imagining a world where crypto is seamlessly integrated into every facet of life, driving innovation and empowerment.

Relevant Link: The Future of Cryptocurrencies